Emerging Insights has developed a solution which allows companies to create combinable Knowledge and predictive, understandable, automatically updated models using Emergent law-based statistics.

This approach uses two fundamental empirical findings:

• We find lots of recurring patterns in data. These patterns can be formalized to what we call emergent laws.

• We empirically show that recurring patterns will keep repeating at a minimum rate again in the future. This can be used to create laws about the lower bound of emergent law-based prediction performance (meta laws).

These fundamental findings enable Emerging Insights to develop AI-solutions that are not viable with standard probability-based approaches. They allow clients not only to increase the performance of their predictive models but also to generate in-depth knowledge about the reasoning behind the model and factors influencing the results and to update this knowledge by objective falsification and updating rules.

Emerging Insights developed a suite of emergent law based ML-algorithms to build models for prediction, decision and causal analysis.

Finding an emergent Law: In every sequence of at least 1500 car sales Volkswagen cars were on average more expensive than Renaults

We are using the following advantages of the emergent law based methods:

They result in the following properties of our approach:

A Module that allows the integration of many KnowledgeWarehouses at the company-level to generate consistent, integrated Knowledge knowledge about all the processes that have been empirically analysedanalyzed within the whole company.

Emergent laws provide natural interfaces that make it possible to use them in other learning, prediction and decision tasks. Therefore our software is able to generate knowledge that can be transferred to new tasks and can be used universally.

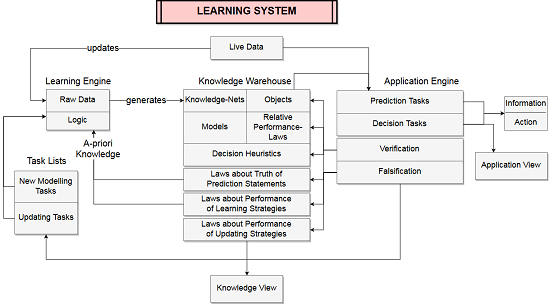

The structure of a learning system

Extends the Base-Module with algorithms that control the stability of the laws in a KnowledgeBase and update the KnowldegeBase after each new observation. This module is extremely useful for Quality Control of technical and business systems or to monitor the stability of social systems.

A Worldview shows how pattern have always been until now (boxes) and their actual state (points)

The prediction, that an observed pattern will keep repeating is objectively verifiable. Therefore it is possible to decide after every new observation, whether the laws in a system are actually stable (“Is it still the same as it always has been?”). This approach allows us to show the state of a system for example by “WorldViews”, dynamic graphs that show how interesting aspects of a system always have been in the past and how they are actually. In a Worldview there are two major sources of signals that show the need for intervention:

With aid of these tools we are able to control the stability of technical systems, business environments and processes objectively and with unprecedented accuracy.

In many cases, by analyzing the actual state of laws in the KnowledgeWarehouse we are able to deliver an instant causal analysis in the case of adverse developments by analyzing the actual state of laws in the KnowledgeWarehouse.

The ability to find patterns that have always been true , to store, combine and update relevant empirical commonsenseworld knowledge in KnowlegeBases and to construct decision rules that always lead always to improved results leads enables us to build potentially very powerful tools. We are sure that the application of our algorithms and our methodology has the potential to change business processes, science and social decision-making substantially. So it is our mission is to spread the knowledge and use of our methods in a responsible way that leads to better informed decisions of institutions and people and to a sustainable improvement of human welfare.

The founders of emerging insights spend more than 30 years in empirical research and the development of predictive models in university, industry and government consulting. The last ten years we spend most of our time in developing the methods and algorithm that are now ready to use for companies and institutions. The founders of emerging insights are:

Since 1991 Andre taught probability based statistics and traditional machine-learning as a post doc at university of Duisburg and since 2001 as a professor for quantitative methods at Baden-Wuerttemberg Cooperative State University.

At the same time he applied quantitative methods in practice for empirical macroeconomic modelling in government consulting, the development of rating systems, the construction of stock-picking algorithms and in research.

During that time he noticed several fundamental detriments of the stochastic methods:

For a couple of years Hans worked for a FinTech focused on bringing real-time, cheap and reliable banking services to institutional and private clients by developing a new core banking system with an emphasis on automation and real-time capabilities.

During his studies he co-authored research papers with André on the foundations of emergent law based statistics, its advantages compared to classical machine-learning algorithms and possible applications.

In his bachelor thesis Hans researched and systemized Meta-Properties of Emergent Laws which now serve as one of the fundamental building blocks guiding the computations of the machine-learning algorithms.

After his studies Hans co-founded Emerging Insights and together with André worked relentlessly on advancing the foundational principles of emergent law based statistics and programming machine-learning algorithms making use thereof in a fast and scalable manner. Hans is also a researcher at the Center of Emergent Law Based Statistics at Baden-Wuerttemberg Cooperative State University.

Since 1999 Norbert Kratz has been teaching business economics, especially accounting and Corporate Finance, as a professor at Baden-Wuerttemberg Cooperative State University.

His special research interests comprise issues related to the identification and interpretation of emergent laws in the fields of finance as well as accounting.

In 2017 he was co-founder of the “Center of emergent law based statistics” (ZES) at Baden-Wuerttemberg Cooperative State University. Since then he has been getting involved with the activities of ZES.

After writing his diploma thesis about the application of emergent law based methods to portfolio management with André and getting his diploma from DHBW in 2008, Jan worked in Equity Trading at a big investment bank.

In parallel he continued his research with André and developed first functional prototypes for finance-related applications of our algorithm. Jan also has gained experience with conventional Machine Learning-methods (and thus knows their shortfalls) over several business and research projects.

He holds a PhD in empirical finance from the University of Wuppertal.

Emerging Insights GmbH

Moltkestraße 17

78166 Donaueschingen

Monday - Friday 09-17 Uhr

If you are interested in our solutions or methods, please don´t hesitate to contact us.